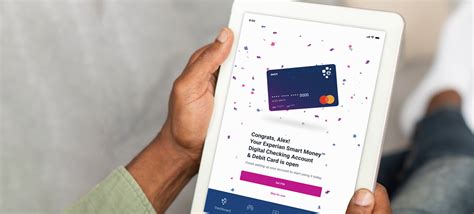

smart money card 2017 Get an Experian Smart Money™ Debit Card that you can add to your digital wallet and start using instantly. Along with your account, you’ll have access to Experian membership benefits like your Experian credit report, FICO ® Score*, credit monitoring and more.

Probably the most significant feature of the iPhone 6 and iPhone 6 Plus, Apple Pay allows you to use your phone to pay for goods and services in lieu of a physical credit card. The technology uses what’s known as NFC, short-hand for “near field communication.”

0 · Should You Trust Experian’s Smart Money Debit Card?

1 · Experian Smart Money™ Review

2 · Experian Smart Money™

3 · Experian Smart Money Review: A Debit Card That Can Build Credit

$6.00Load your Mastercard credit, debit or prepaid cards into Android Pay and make secure mobile .

Should You Trust Experian’s Smart Money Debit Card?

For the past year, Experian has been testing its Smart Money debit card, which it advertises as a way to “build credit without the debt.” Our columnist says to be wary.Get an Experian Smart Money™ Debit Card that you can add to your digital wallet and start using instantly. Along with your account, you’ll have access to Experian membership benefits like . The Experian Smart Money Digital Checking account has no monthly fees, no minimum balance requirements, no overdraft fees and is FDIC-insured through Community . The Experian Smart Money™ Card is a combination debit card and digital checking account from Experian and Community Federal Savings Bank, Member-FDIC. The card is an .

For the past year, Experian has been testing its Smart Money debit card, which it advertises as a way to “build credit without the debt.” Our columnist says to be wary.Get an Experian Smart Money™ Debit Card that you can add to your digital wallet and start using instantly. Along with your account, you’ll have access to Experian membership benefits like your Experian credit report, FICO ® Score*, credit monitoring and more. The Experian Smart Money Digital Checking account has no monthly fees, no minimum balance requirements, no overdraft fees and is FDIC-insured through Community Federal Savings Bank. You’ll also get access to over 55,000 free ATMs nationwide through Allpoint’s ATM network.

The Experian Smart Money™ Card is a combination debit card and digital checking account from Experian and Community Federal Savings Bank, Member-FDIC. The card is an exciting debit card designed by experts in the credit space – . Experian Smart Money™ is a new digital checking account and debit card that links to Experian Boost ®, which automatically gives you credit for eligible payments. You’ll also pay no monthly fees and have access to more than 55,000 fee-free ATMs worldwide. Experian Smart Money™ is a new digital checking account and debit card that links to Experian Boost®, which gives you credit for eligible bill payments. Some of its standout benefits include no monthly fees and access to more than 55,000 fee-free ATMs. Explore Experian Smart Money, a checking account and debit card with financial tools that help you build your credit by making on-time bill payments.

Experian. 25.6K subscribers. Subscribed. 15. 664K views 3 months ago. Introducing the Experian Smart Money™ Debit Card and Digital Checking Account. It can help you build your credit without. Here are three smart money moves you can make in 2017, along with some tips to help you succeed. 1. Get rid of credit card debt. High-interest-rate credit card debt can seriously hold. From filing quarterly taxes to talking finances with your family, these five money tasks will help get your year off to a good start.

For the past year, Experian has been testing its Smart Money debit card, which it advertises as a way to “build credit without the debt.” Our columnist says to be wary.Get an Experian Smart Money™ Debit Card that you can add to your digital wallet and start using instantly. Along with your account, you’ll have access to Experian membership benefits like your Experian credit report, FICO ® Score*, credit monitoring and more.

The Experian Smart Money Digital Checking account has no monthly fees, no minimum balance requirements, no overdraft fees and is FDIC-insured through Community Federal Savings Bank. You’ll also get access to over 55,000 free ATMs nationwide through Allpoint’s ATM network.

The Experian Smart Money™ Card is a combination debit card and digital checking account from Experian and Community Federal Savings Bank, Member-FDIC. The card is an exciting debit card designed by experts in the credit space – .

Experian Smart Money™ is a new digital checking account and debit card that links to Experian Boost ®, which automatically gives you credit for eligible payments. You’ll also pay no monthly fees and have access to more than 55,000 fee-free ATMs worldwide.

Experian Smart Money™ is a new digital checking account and debit card that links to Experian Boost®, which gives you credit for eligible bill payments. Some of its standout benefits include no monthly fees and access to more than 55,000 fee-free ATMs. Explore Experian Smart Money, a checking account and debit card with financial tools that help you build your credit by making on-time bill payments.Experian. 25.6K subscribers. Subscribed. 15. 664K views 3 months ago. Introducing the Experian Smart Money™ Debit Card and Digital Checking Account. It can help you build your credit without. Here are three smart money moves you can make in 2017, along with some tips to help you succeed. 1. Get rid of credit card debt. High-interest-rate credit card debt can seriously hold.

Experian Smart Money™ Review

smart card windows security

Contactless cards work a lot like mobile wallets. The transaction is completed by holding or tapping the card on a contactless-enabled card reader. The technology is also known as “tap to pay” or “tap and go.”. It’s up to 10 .

smart money card 2017|Experian Smart Money™