smart card m1 or m2 M2 = M1 + savings deposits + money market funds + certificates of deposit + other time .

I think that's right. New 3DS won't look for the NFC reader via infrared since the NFC reader is built in. But a homebrew app should be able to run on either a New or Old 3DS. You should be able to use an New 3DS to .

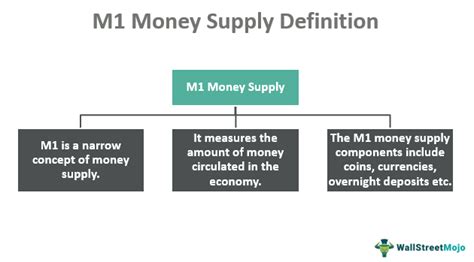

0 · what is m1 money supply

1 · what does m1 mean for money

2 · what does m1 mean

3 · measuring money m1

4 · m1 vs m2 calculator

5 · m1 vs m2

6 · m1 and m2 money

7 · m1 and m2 meaning

NFC tags are passive data stores that can be read and under some circumstances written to, by an NFC device. Typically, they contain data and are read-only in normal use, but may be rewritable. Apps include secure .

We defined money as anything that is generally accepted as a means of payment, is a store of value, can be used as a unit of account or a standard of deferred payment. What exactly is included? Cash in your pocket certainly serves as money. But what about checks or credit cards? Are they money, too? Rather than . See more

M1 is the most narrow definition of the money supply. It includes coins and currency in circulation—in other words they are not held held by the U.S. Treasury, or the Federal Reserve Bank, but circulate in the economy. Closely related to currency . See more

A broader definition of money, M2 includes everything in M1 but also adds other types of deposits. For example, M2 includes savings deposits in banks, which are bank accounts on which you cannot write a check directly, but from which you can easily withdraw the . See moreWhere does “plastic money” like debit cards, credit cards, and smart money fit into this picture? A debit card, like a check, is an instruction to the user’s bank to transfer money directly and immediately from your bank account to the seller. Thus, a debit card is every . See moreIf Sarah uses her smart card to purchase movies over the internet, then the money to pay the .

M2 = M1 + savings deposits + money market funds + certificates of deposit + other time .M1 and M2 money are the two mostly commonly used definitions of money. M1 = coins and currency in circulation + checkable (demand) deposit + traveler’s checks + saving deposits. M2 = M1 + money market funds + certificates of deposit + other time deposits.If Sarah uses her smart card to purchase movies over the internet, then the money to pay the retailer will come from: Sarah's M1 funds. ________________ serves society in three functions: medium of exchange, unit of account, and store of value. money.M2 = M1 + savings deposits + money market funds + certificates of deposit + other time deposits. The Federal Reserve System is responsible for tracking the amounts of M1 and M2 and prepares a weekly release of information about the money supply.

what is m1 money supply

M1 money includes coins and currency in circulation. The M2 money supply is less liquid and is measured as M1 plus time deposits, certificates of deposit, and money market funds. How does "plastic money" (debit cards, credit cards, and smart cards) fit into this scenario?M1 and M2 money are the two mostly commonly used definitions of money. M1 = coins and currency in circulation + checkable (demand) deposit + traveler’s checks.The Relationship between M1 and M2 Money. M1 and M2 money have several definitions, ranging from narrow to broad. M1 = coins and currency in circulation + checkable (demand) deposit + traveler’s checks. M2 = M1 + savings deposits + money market funds + certificates of deposit + other time deposits.

what does m1 mean for money

This free textbook is an OpenStax resource written to increase student access to high-quality, peer-reviewed learning materials.M1 and M2 money have several definitions, ranging from narrow to broad. M1 = coins and currency in circulation + checkable (demand) deposit + traveler’s checks. M2 = M1 + savings deposits + money market funds + certificates of deposit + other time deposits.

M2 = M1 + savings deposits + money market funds + certificates of deposit + other time deposits. The Federal Reserve System is responsible for tracking the amounts of M1 and M2 and prepares a weekly release of information about the money supply.The Relationship between M1 and M2 Money. M1 and M2 money have several definitions, ranging from narrow to broad. M1 = coins and currency in circulation + checkable (demand) deposit + traveler’s checks. M2 = M1 + savings deposits + money market funds + certificates of deposit + other time deposits.

M1 and M2 money are the two mostly commonly used definitions of money. M1 = coins and currency in circulation + checkable (demand) deposit + traveler’s checks + saving deposits. M2 = M1 + money market funds + certificates of deposit + other time deposits.If Sarah uses her smart card to purchase movies over the internet, then the money to pay the retailer will come from: Sarah's M1 funds. ________________ serves society in three functions: medium of exchange, unit of account, and store of value. money.M2 = M1 + savings deposits + money market funds + certificates of deposit + other time deposits. The Federal Reserve System is responsible for tracking the amounts of M1 and M2 and prepares a weekly release of information about the money supply.

M1 money includes coins and currency in circulation. The M2 money supply is less liquid and is measured as M1 plus time deposits, certificates of deposit, and money market funds. How does "plastic money" (debit cards, credit cards, and smart cards) fit into this scenario?M1 and M2 money are the two mostly commonly used definitions of money. M1 = coins and currency in circulation + checkable (demand) deposit + traveler’s checks.The Relationship between M1 and M2 Money. M1 and M2 money have several definitions, ranging from narrow to broad. M1 = coins and currency in circulation + checkable (demand) deposit + traveler’s checks. M2 = M1 + savings deposits + money market funds + certificates of deposit + other time deposits.

This free textbook is an OpenStax resource written to increase student access to high-quality, peer-reviewed learning materials.M1 and M2 money have several definitions, ranging from narrow to broad. M1 = coins and currency in circulation + checkable (demand) deposit + traveler’s checks. M2 = M1 + savings deposits + money market funds + certificates of deposit + other time deposits.M2 = M1 + savings deposits + money market funds + certificates of deposit + other time deposits. The Federal Reserve System is responsible for tracking the amounts of M1 and M2 and prepares a weekly release of information about the money supply.

mastercard contactless cards in the usa

what does m1 mean

Write SMS Action To NFC Tag. Copyright © 2023 NFCToolsOnline

smart card m1 or m2|m1 vs m2 calculator