rhb smart value credit card cash advance CashXcess. Need extra cash? Now, you can get fast cash from your RHB Credit Card/-i. Apply RHB CashXcess now to enjoy interest rate/actual management fee starting from 4.88%p.a. . Amazon.com: Nfc Business Card. 1-48 of 542 results for "nfc business card" Results. Check each product page for other buying options. Price and other details may vary based on product size and color. dot. Card - Digital Business Card - Tap to Share - iPhone & Android (Black) 562. 1K+ bought in past month. $1999.

0 · rhb credit card withdrawal

1 · rhb cashxcess sign in

2 · rhb cash xcess

3 · hsbc cash advance fee

4 · credit card cash advance rates

5 · credit card cash advance fee

6 · credit card cash advance

7 · cash advance credit card application

39 Pcs NFC Cards Compatible with Amibo Legend of Zelda Breath of The Wild. Limited time .

CashXcess. Need extra cash? Now, you can get fast cash from your RHB Credit Card/-i. Apply RHB CashXcess now to enjoy interest rate/actual management fee starting from 4.88%p.a. .Enjoy extra cash by converting your available credit limit with CashXcess or . Get the extra cash from your credit limit with RHB Credit Card/-i for what matters most. Want extra cash for your daily needs? You can now convert up to 80% of your credit . If you really need cash from your credit card, a new way of lending has been devised: enter the cash installment plan (CIP) for your credit card, charged to you at a fixed installment .

Enjoy extra cash by converting your available credit limit with CashXcess or settle outstanding credit card debts with Balance Transfer. No hassles and no headaches! .If you make your payment for RHB Cash Back Credit Card for 12 consecutive months, you can get an interest of 15% per annum. If you have made payment for 10 out of 12 months, you will get .

Earn 10% cashback on online dining and grocery categories and 5% cashback for petrol, dining, utilities and grocery categories when spending RM2,500 and above. Cashback is capped at .A guide to our charges & rates offered. Savings Account. Current Account. Premier Current Account. Fixed Deposit. Credit Card. Business Credit Card. Debit Card. Note: Inclusive of any .June 13, 2024. Credit: Yuliya Padina / Shutterstock. When you're short on cash but have available credit on your card, your credit card 's cash advance feature allows you to borrow. A cash advance is a short-term loan on your credit card account. It’s a simple transaction that can have very expensive consequences. More often than not, it’s a terrible .

With no annual fee and options to earn cash back the RHB Visa Signature is a good choice for Malaysians looking for a credit card. However, credit cards can still be an .CashXcess. Need extra cash? Now, you can get fast cash from your RHB Credit Card/-i. Apply RHB CashXcess now to enjoy interest rate/actual management fee starting from 4.88%p.a. from 12 months tenure. Lengthened payment period of up to 48 months. Withdrawal up to 80% of your available credit limit. No processing fee or early exit fee penalty. Get the extra cash from your credit limit with RHB Credit Card/-i for what matters most. Want extra cash for your daily needs? You can now convert up to 80% of your credit limit into cash via CashXcess on RHB Online Banking with your desired tenure. It will be credited into your account with no hassles, no supporting documents needed! Programme . If you really need cash from your credit card, a new way of lending has been devised: enter the cash installment plan (CIP) for your credit card, charged to you at a fixed installment payment amount with varying interest rates.

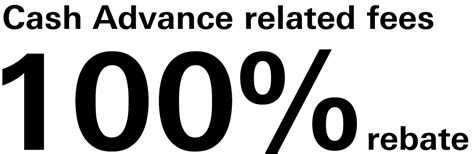

Enjoy extra cash by converting your available credit limit with CashXcess or settle outstanding credit card debts with Balance Transfer. No hassles and no headaches! Exclusively for new RHB Credit Card/-i applications. Campaign Period: 1 January 2024 - 31 December 2024

rhb credit card withdrawal

rhb cashxcess sign in

If you make your payment for RHB Cash Back Credit Card for 12 consecutive months, you can get an interest of 15% per annum. If you have made payment for 10 out of 12 months, you will get an interest of 17% per annum and you will get 18% per annum if both criteria were not fulfilled.Earn 10% cashback on online dining and grocery categories and 5% cashback for petrol, dining, utilities and grocery categories when spending RM2,500 and above. Cashback is capped at RM10 per category per month. Discover how much you can save when you shop with your new RHB Cash Back MasterCard Credit Card Card. CASHBACK CATEGORY.

A guide to our charges & rates offered. Savings Account. Current Account. Premier Current Account. Fixed Deposit. Credit Card. Business Credit Card. Debit Card. Note: Inclusive of any applicable taxes imposed from time to time.

June 13, 2024. Credit: Yuliya Padina / Shutterstock. When you're short on cash but have available credit on your card, your credit card 's cash advance feature allows you to borrow. A cash advance is a short-term loan on your credit card account. It’s a simple transaction that can have very expensive consequences. More often than not, it’s a terrible idea. » MORE: Can. With no annual fee and options to earn cash back the RHB Visa Signature is a good choice for Malaysians looking for a credit card. However, credit cards can still be an expensive choice, particularly overseas and if you run into interest and penalty charges.

CashXcess. Need extra cash? Now, you can get fast cash from your RHB Credit Card/-i. Apply RHB CashXcess now to enjoy interest rate/actual management fee starting from 4.88%p.a. from 12 months tenure. Lengthened payment period of up to 48 months. Withdrawal up to 80% of your available credit limit. No processing fee or early exit fee penalty. Get the extra cash from your credit limit with RHB Credit Card/-i for what matters most. Want extra cash for your daily needs? You can now convert up to 80% of your credit limit into cash via CashXcess on RHB Online Banking with your desired tenure. It will be credited into your account with no hassles, no supporting documents needed! Programme . If you really need cash from your credit card, a new way of lending has been devised: enter the cash installment plan (CIP) for your credit card, charged to you at a fixed installment payment amount with varying interest rates.

Enjoy extra cash by converting your available credit limit with CashXcess or settle outstanding credit card debts with Balance Transfer. No hassles and no headaches! Exclusively for new RHB Credit Card/-i applications. Campaign Period: 1 January 2024 - 31 December 2024If you make your payment for RHB Cash Back Credit Card for 12 consecutive months, you can get an interest of 15% per annum. If you have made payment for 10 out of 12 months, you will get an interest of 17% per annum and you will get 18% per annum if both criteria were not fulfilled.Earn 10% cashback on online dining and grocery categories and 5% cashback for petrol, dining, utilities and grocery categories when spending RM2,500 and above. Cashback is capped at RM10 per category per month. Discover how much you can save when you shop with your new RHB Cash Back MasterCard Credit Card Card. CASHBACK CATEGORY.

A guide to our charges & rates offered. Savings Account. Current Account. Premier Current Account. Fixed Deposit. Credit Card. Business Credit Card. Debit Card. Note: Inclusive of any applicable taxes imposed from time to time.June 13, 2024. Credit: Yuliya Padina / Shutterstock. When you're short on cash but have available credit on your card, your credit card 's cash advance feature allows you to borrow. A cash advance is a short-term loan on your credit card account. It’s a simple transaction that can have very expensive consequences. More often than not, it’s a terrible idea. » MORE: Can.

rhb cash xcess

read hid card with nfc

Your business moves fast, but your custom business card and online experience keep all your customers, connections and partners up to date. You can update your site . See more

rhb smart value credit card cash advance|cash advance credit card application