is it smart to close and open credit cards Canceling a credit card can hurt your credit score, but that doesn't mean you have to leave a card open forever. There are good reasons to . PDF Download. Universal Smart Cards has added the ACR1252U NFC Forum development kit to our shop to help developers focus on NFC applications. .

0 · why not to close credit cards

1 · why not close credit cards early

2 · why not close credit cards before 1 year

3 · should i close my credit card early

4 · should i close credit cards before 1 year

5 · should i close credit cards

6 · is it illegal to close credit cards

7 · closing a credit card pros and cons

Drivers for ACR122U. USB Interface. OS Support. MSI Installer for PC/SC Driver 5.22 MB. Version 4.2.8.0. 20-Mar-2018. Windows® XP, Windows® Vista, Windows® 7, Windows® 8, Windows® 8.1, Windows® 10, Windows® .

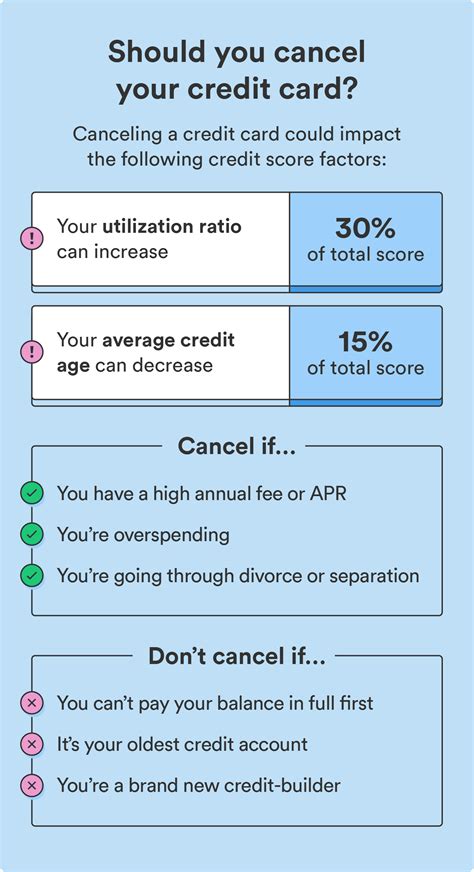

If you close an old card, you could be removing an established line of credit, which can impact the "length of credit history" part of your score. Credit utilization -- basically, the percentage . Canceling a credit card can hurt your credit score, but that doesn't mean you have to leave a card open forever. There are good reasons to . If you close an old card, you could be removing an established line of credit, which can impact the "length of credit history" part of your score. Credit utilization -- basically, the percentage .If you are considering closing a credit card, this gives you an opportunity to close the credit card account with a highest interest rate. In the long run, maintaining financial health could be much better for your credit score than the benefits of keeping the card account open.

Canceling a credit card can hurt your credit score, but that doesn't mean you have to leave a card open forever. There are good reasons to cancel, too.

The answer is worth repeating loud and clear: Never, under any circumstances, should you close a credit card less than one year after opening it. While it is possible to do so, there are many reasons why canceling a credit card before the annual fee is due is a bad idea. A crowded wallet and the temptation to spend might have you thinking about canceling unused credit card accounts. In most cases, however, it's best to keep unused credit cards open so you benefit from longer credit history and lower credit utilization (as a result of more available credit). While there are some advantages to closing a credit card you've paid off, it's important to know what closing a credit card won't accomplish. For example, many people think closing a credit card will improve their credit score.

If you plan to cancel a credit card because you no longer want to pay the annual fee, you may be able to keep the account open without the yearly cost. Call your credit card issuer to ask.

Closing a credit card can hurt your credit score, particularly if it's an older card or has a high limit. But there are ways to do it strategically and safely. Often, there may be smarter ways to achieve your goal of lower costs and less debt. Key Takeaways. People close credit cards for many reasons, including excessive spending, avoiding. But if a credit card has an annual fee, and the value you get from the card doesn't justify continuing to pay it, it can be a smart idea to close it. If you close an old card, you could be removing an established line of credit, which can impact the "length of credit history" part of your score. Credit utilization -- basically, the percentage .

If you are considering closing a credit card, this gives you an opportunity to close the credit card account with a highest interest rate. In the long run, maintaining financial health could be much better for your credit score than the benefits of keeping the card account open. Canceling a credit card can hurt your credit score, but that doesn't mean you have to leave a card open forever. There are good reasons to cancel, too. The answer is worth repeating loud and clear: Never, under any circumstances, should you close a credit card less than one year after opening it. While it is possible to do so, there are many reasons why canceling a credit card before the annual fee is due is a bad idea. A crowded wallet and the temptation to spend might have you thinking about canceling unused credit card accounts. In most cases, however, it's best to keep unused credit cards open so you benefit from longer credit history and lower credit utilization (as a result of more available credit).

While there are some advantages to closing a credit card you've paid off, it's important to know what closing a credit card won't accomplish. For example, many people think closing a credit card will improve their credit score.

why not to close credit cards

why not close credit cards early

If you plan to cancel a credit card because you no longer want to pay the annual fee, you may be able to keep the account open without the yearly cost. Call your credit card issuer to ask.

Closing a credit card can hurt your credit score, particularly if it's an older card or has a high limit. But there are ways to do it strategically and safely.

Often, there may be smarter ways to achieve your goal of lower costs and less debt. Key Takeaways. People close credit cards for many reasons, including excessive spending, avoiding.

why not close credit cards before 1 year

should i close my credit card early

Apple has enabled all the iPhones from iPhone 6 to the latest iPhone 12 to work with the NFC tags or cards. The NFC reader on your iPhone can read the information from an NFC tag and automate tasks for you. .Posted on Nov 1, 2021 12:10 PM. On your iPhone, open the Shortcuts app. Tap on the Automation tab at the bottom of your screen. Tap on Create Personal Automation. Scroll down and select NFC. Tap on Scan. Put .

is it smart to close and open credit cards|why not close credit cards early