cash plus card contactless With the U.S. Bank Cash+ ® Visa cash back credit card, you can earn 5% cash back on your first $2,000 in eligible net purchases each quarter on the combined two categories you choose. You earn 2% cash back on your choice of one everyday category, and 1% cash back on all other eligible net purchases. Go to the settings menu, locate the NFC option, and toggle it on. This will activate the NFC chip in your device, allowing it to communicate with RFID tags. 3. Install a compatible .

0 · us bank cash plus visa signature

1 · us bank cash plus sign in

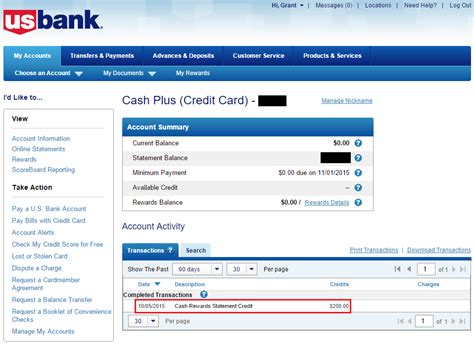

2 · us bank cash plus rewards

3 · us bank cash plus redeem

4 · us bank cash plus cash back

5 · us bank cash plus card review

6 · us bank cash plus 0

1. If you want to make a Tag that is readOnly to everything except your App then most Tags offer password protecting the write operation, BUT how to do this is usually specific to the make and model of the Tag's you are using. So you don't specify the make and model of .

us bank cash plus visa signature

rfid tags for sale uk

With the U.S. Bank Cash+ ® Visa cash back credit card, you can earn 5% cash back on your first ,000 in eligible net purchases each quarter on the combined two categories you choose. You earn 2% cash back on your choice of one . The U.S. Bank Cash+ Signature card is a great no annual fee cash-back card that lets you tailor your rewards to your spending habits.With the U.S. Bank Cash+ ® Visa cash back credit card, you can earn 5% cash back on your first ,000 in eligible net purchases each quarter on the combined two categories you choose. You earn 2% cash back on your choice of one everyday category, and 1% cash back on all other eligible net purchases. The U.S. Bank Cash+ Signature card is a great no annual fee cash-back card that lets you tailor your rewards to your spending habits.

The U.S. Bank Cash+® Visa Signature® Card earns 5% cash back on prepaid air, hotel and car reservations booked directly in the Rewards Travel Center, 5% cash back on your first ,000 in .

The Bottom Line. 4.5. NerdWallet rating. This card is a good match for avid rewards optimizers — those who juggle cards strategically to get the best return for every dollar. It works fine as.Build credit 1 and earn cash back. 3. Earn unlimited cash back while building credit for the future. Start with a security deposit of 0 to ,000 and The U.S. Bank Cash+ Visa Signature Card, on the other hand, lets you choose your categories, and its limit is 33% higher — ,000 of eligible spending each quarter. Unlike its competitors, it also lets you choose a 2% bonus cash category — . annual fee. 5% cash back 3 on two categories you choose each quarter 4. 2% cash back 3 on one everyday category, like gas stations and EV charging stations, grocery stores or restaurants. Contactless credit cards provide a safer, quicker way to pay in store. Here are the best tap-to-pay cards for cash back, groceries, gas, food delivery and 0% APR. To identify the best contactless credit cards, WalletHub’s editors routinely compare the latest rewards, interest rates, fees, approval requirements, and contactless features offered by 1,500+ credit cards, including cards from WalletHub’s partners and notable new offers.

Pros & Cons. Card Highlights. Keep your U.S. Bank Cash+ Signature card as long as you desire as you’ll never have to pay an annual fee. Bottom Line: The U.S. Bank Cash+ Signature card does not charge an annual fee and comes with a generous welcome offer.

Tap and go or contactless credit cards can help you stay germ-free. Here's our experts' picks for best contactless credit cards -- find the one for you in our in-depth review.With the U.S. Bank Cash+ ® Visa cash back credit card, you can earn 5% cash back on your first ,000 in eligible net purchases each quarter on the combined two categories you choose. You earn 2% cash back on your choice of one everyday category, and 1% cash back on all other eligible net purchases. The U.S. Bank Cash+ Signature card is a great no annual fee cash-back card that lets you tailor your rewards to your spending habits.

us bank cash plus sign in

The U.S. Bank Cash+® Visa Signature® Card earns 5% cash back on prepaid air, hotel and car reservations booked directly in the Rewards Travel Center, 5% cash back on your first ,000 in .The Bottom Line. 4.5. NerdWallet rating. This card is a good match for avid rewards optimizers — those who juggle cards strategically to get the best return for every dollar. It works fine as.Build credit 1 and earn cash back. 3. Earn unlimited cash back while building credit for the future. Start with a security deposit of 0 to ,000 and The U.S. Bank Cash+ Visa Signature Card, on the other hand, lets you choose your categories, and its limit is 33% higher — ,000 of eligible spending each quarter. Unlike its competitors, it also lets you choose a 2% bonus cash category — . annual fee. 5% cash back 3 on two categories you choose each quarter 4. 2% cash back 3 on one everyday category, like gas stations and EV charging stations, grocery stores or restaurants. Contactless credit cards provide a safer, quicker way to pay in store. Here are the best tap-to-pay cards for cash back, groceries, gas, food delivery and 0% APR.

To identify the best contactless credit cards, WalletHub’s editors routinely compare the latest rewards, interest rates, fees, approval requirements, and contactless features offered by 1,500+ credit cards, including cards from WalletHub’s partners and notable new offers.

Pros & Cons. Card Highlights. Keep your U.S. Bank Cash+ Signature card as long as you desire as you’ll never have to pay an annual fee. Bottom Line: The U.S. Bank Cash+ Signature card does not charge an annual fee and comes with a generous welcome offer.

Using Core NFC, you can read Near Field Communication (NFC) tags of types 1 through 5 that contain data in the NFC Data Exchange Format (NDEF). For example, your app might give .

cash plus card contactless|us bank cash plus cash back