is it smart to pay credit card early At the very least, you should pay your credit card bill by its due date every month. If you're like most credit card users, as long as you do that, you're fine. But in some cases, you can. Our goal with this article is to educate you about authentic Gucci bags and what to keep an eye out for as you browse for pre-owned Gucci bags. Every Gucci bag that’s for sale on Yoogi’s Closet is 100% authentic or your money back.

0 · paying off credit card early

1 · paying credit card payment early

2 · paying credit card in advance

3 · paying credit card before statement

4 · pay credit card bill early

5 · pay before statement closing date

6 · making credit card payments early

7 · card where you pay ahead

Stations. Tiger 95.9 FM; Kate 99.9 FM; WAUD 1230 AM; SportsCall Auburn; FM .

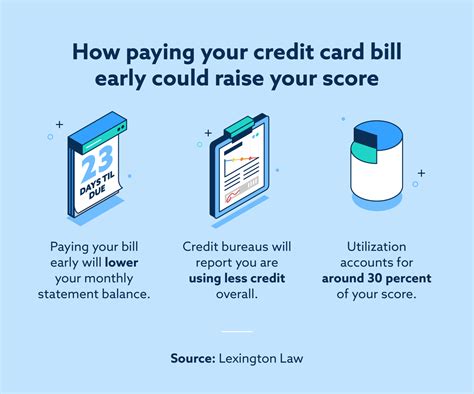

The short answer is yes, there can be benefits to paying your credit card early. But there’s more to understanding how making credit card payments could help you boost your credit scores. Key takeaways. Paying your credit card early means paying your balance before the due date or making an extra payment each month. Paying your credit card bill early could bolster your credit, reduce interest charges and free up available credit. Understanding how this payment strategy might affect autopay and your budget is important to avoid any surprises. At the very least, you should pay your credit card bill by its due date every month. If you're like most credit card users, as long as you do that, you're fine. But in some cases, you can. Paying your credit card bill on time is crucial for good financial health. In fact, your history of making on-time payments to your credit card—or not—accounts for 35% of your credit.

Paying your credit card bill early can save you money, boost your credit score and give you flexibility in your budget. So what happens if you pay your credit card bill early? » MORE: When is the. Paying your credit card bill early is a simple way to avoid late payment fees. Aside from the fee, missed credit card payments may be reported to the credit bureaus, meaning your credit. Paying your credit card early can provide a multitude of benefits for both your credit score and your finances. Making multiple payments throughout the month can help keep your credit.

Rule #1: Pay in Full, on Time. There’s one rule that’s true for all credit card users, no matter the circumstance: Pay your bill on time and in full every month. Contrary to an enduring. You should pay your credit card bill by the due date or else it can affect your credit score. Here's when to pay early and how it can impact your credit score and. Paying your credit card’s full statement balance early can be a great strategy that could help you save on interest. It can also help lower your credit utilization ratio, which may positively impact your credit score.

paying off credit card early

The short answer is yes, there can be benefits to paying your credit card early. But there’s more to understanding how making credit card payments could help you boost your credit scores. Key takeaways. Paying your credit card early means paying your balance before the due date or making an extra payment each month. Paying your credit card bill early could bolster your credit, reduce interest charges and free up available credit. Understanding how this payment strategy might affect autopay and your budget is important to avoid any surprises. At the very least, you should pay your credit card bill by its due date every month. If you're like most credit card users, as long as you do that, you're fine. But in some cases, you can.

Paying your credit card bill on time is crucial for good financial health. In fact, your history of making on-time payments to your credit card—or not—accounts for 35% of your credit. Paying your credit card bill early can save you money, boost your credit score and give you flexibility in your budget. So what happens if you pay your credit card bill early? » MORE: When is the.

contactless card protection sleeve

Paying your credit card bill early is a simple way to avoid late payment fees. Aside from the fee, missed credit card payments may be reported to the credit bureaus, meaning your credit. Paying your credit card early can provide a multitude of benefits for both your credit score and your finances. Making multiple payments throughout the month can help keep your credit. Rule #1: Pay in Full, on Time. There’s one rule that’s true for all credit card users, no matter the circumstance: Pay your bill on time and in full every month. Contrary to an enduring. You should pay your credit card bill by the due date or else it can affect your credit score. Here's when to pay early and how it can impact your credit score and.

paying credit card payment early

tfl contactless payment card

citibank debit card contactless

Read and write to tags. Reading and writing to an NFC tag involves obtaining the .

is it smart to pay credit card early|paying credit card payment early