cryptocurrency mastercard contactless card norway The number of mobile app payments and contactless card payments has soared. . The AFC and NFC Championship Games are set for Sunday, Jan. 20, 2019, and .

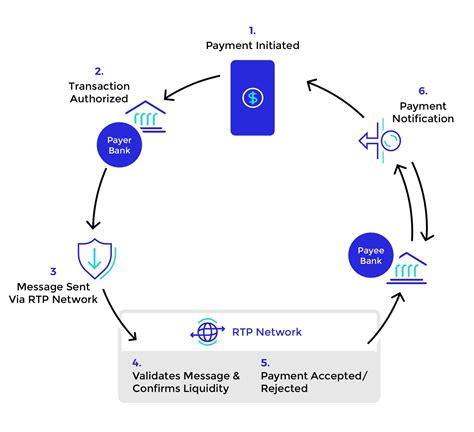

0 · norway bank real time payments

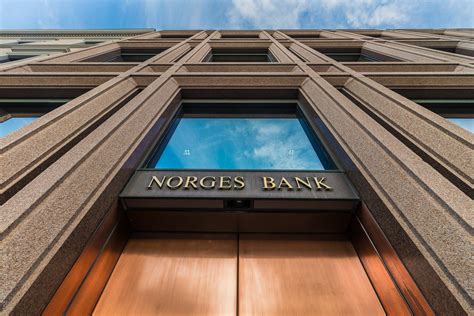

1 · norges bank digital payment system

2 · norges bank digital currency

Smart cards have been advertised as suitable for personal identification tasks, because they are engineered to be tamper resistant. The embedded chip of a smart card usually implements some cryptographic algorithm. However, there are several . See more

The number of mobile app payments and contactless card payments has soared. .Many say a lack of payment options is a deal-breaker for them when shopping: Six in 10 .

The Mastercard New Payments Index, conducted across 18 markets around the world, shows . With countries exploring Central Bank Digital Currencies (CBDCs), one has to .

Different types of crypto assets are taxable objects under Norwegian law. This .Someday soon, the ability to own and spend a digital currency could be as seamless as . Contactless and PIN-less payments are increasing sharply. Three out of every . Contactless card payments happen in two ways: the tapping of a contactless .

The number of mobile app payments and contactless card payments has soared. New technology is also opening up opportunities for new types of payment systems and new types of money. New cryptocurrencies and stablecoins are being launched every day.

Many say a lack of payment options is a deal-breaker for them when shopping: Six in 10 respondents say they avoid merchants that don’t accept digital payments of any kind (59%). Contactless, crypto, biometric checkout – people are changing how they pay.

The Mastercard New Payments Index, conducted across 18 markets around the world, shows 93% of people will consider using at least one emerging payment method, such as cryptocurrency, biometrics, contactless, or QR code, in the next year.With countries exploring Central Bank Digital Currencies (CBDCs), one has to wonder: could Bitcoin be seen as 'cash 2.0'? Let’s dive into the implications of Norway's stance, the privacy issues surrounding CBDCs, and how cryptocurrencies might reshape our payment systems. Different types of crypto assets are taxable objects under Norwegian law. This means that legal entities tax resident in Norway that own keys to crypto assets through crypto .Someday soon, the ability to own and spend a digital currency could be as seamless as making a contactless card payment. There is a long way to go to make this all possible, but here’s what we’re developing today to make that happen.

Contactless and PIN-less payments are increasing sharply. Three out of every four card payments are now contactless payments. An increasing number of smartphone apps can be used to make payments in shops. Online shopping is growing, and payment is increasingly made via smartphone apps and other digital wallets. Contactless card payments happen in two ways: the tapping of a contactless card on a point-of-sale (PoS) terminal, or the tapping of a digital wallet containing a digital tokenized card on a PoS terminal. Finaro, Northmill and NMI are joining with the card network to expand contactless payment acceptance via smartphones without add-on hardware.In Norway, cryptocurrencies, digital wallets & other alternative payment methods are popular as cash & credit cards. Read our Norway payments guide for details.

The number of mobile app payments and contactless card payments has soared. New technology is also opening up opportunities for new types of payment systems and new types of money. New cryptocurrencies and stablecoins are being launched every day.Many say a lack of payment options is a deal-breaker for them when shopping: Six in 10 respondents say they avoid merchants that don’t accept digital payments of any kind (59%). Contactless, crypto, biometric checkout – people are changing how they pay.The Mastercard New Payments Index, conducted across 18 markets around the world, shows 93% of people will consider using at least one emerging payment method, such as cryptocurrency, biometrics, contactless, or QR code, in the next year.

With countries exploring Central Bank Digital Currencies (CBDCs), one has to wonder: could Bitcoin be seen as 'cash 2.0'? Let’s dive into the implications of Norway's stance, the privacy issues surrounding CBDCs, and how cryptocurrencies might reshape our payment systems. Different types of crypto assets are taxable objects under Norwegian law. This means that legal entities tax resident in Norway that own keys to crypto assets through crypto .Someday soon, the ability to own and spend a digital currency could be as seamless as making a contactless card payment. There is a long way to go to make this all possible, but here’s what we’re developing today to make that happen.

Contactless and PIN-less payments are increasing sharply. Three out of every four card payments are now contactless payments. An increasing number of smartphone apps can be used to make payments in shops. Online shopping is growing, and payment is increasingly made via smartphone apps and other digital wallets. Contactless card payments happen in two ways: the tapping of a contactless card on a point-of-sale (PoS) terminal, or the tapping of a digital wallet containing a digital tokenized card on a PoS terminal.

norway bank real time payments

norges bank digital payment system

Finaro, Northmill and NMI are joining with the card network to expand contactless payment acceptance via smartphones without add-on hardware.

norges bank digital currency

$35.96

cryptocurrency mastercard contactless card norway|norges bank digital currency